Can owners trust the information tenants are providing on rental applications in Los Angeles?

At Bell Properties, we’ve come across some alarming data out of the Atlanta rental market, which says that up to 50% of rental applications contain falsified information. While this problem has not reached Los Angeles at quite the same scale, it’s a warning that owners and landlords here should heed. The conditions that enable rental application fraud in Atlanta exist in the LA market, and there are specific things that all of us need to watch for as applications are collected and screened.

Let’s take a look at what’s happening, what owners should watch out for, and how Bell Properties can be the best resource in pushing back against potential fraud and ensuring that only well-qualified tenants are placed in the properties you’re renting out.

Bell Properties Quick Summary:

|

Why Is Application Fraud on the Rise?

Rents have risen faster than incomes, and that has made renting a home increasingly unaffordable for many tenants. A two-bedroom apartment in Atlanta costs an average of $2,000. While this would be extremely affordable in LA, for Atlanta renters, the price tag is out of reach, and there’s a concern that their honest credentials would not result in an approval while applying for the property.

It’s also an inventory problem. Atlanta has added 111,000 new apartments since 2020, but the market lost 230,000 affordable units priced under $1,500 between 2018 and 2023. That has led to an over-supply of luxury apartments and a serious shortage of affordable units.

This leaves renters squeezed. Some turn to fraud out of desperation.

So, rather than looking for a smaller rental home or choosing an area that might have lower rents, they’re fraudulently completing their rental applications. What concerns so many property managers in that market is the fact that they’re getting better at concealing that fraud.

At Bell Properties, we can see how this might work in LA as well.

Rising rents in our own market have created intense competition for limited affordable housing, and that could lead some tenants to feel desperate enough to submit fraudulent rental applications.

As average rental prices continue to climb well beyond what many working individuals and families can reasonably afford, prospective renters often find themselves excluded from desirable neighborhoods or even basic housing options.

In this high-pressure environment, falsifying income documents, inflating credit scores, or misrepresenting employment status may appear to some as the only way to secure a home.

The lack of affordable units worsens this issue by shrinking the pool of legitimate opportunities for renters with moderate or unstable incomes. New laws require landlords who collect application fees to accept the first applicant who meets all the documented criteria. There’s no opportunity to comb through applications looking for those who appear most financially stable. This incentivizes applicants to exaggerate their credentials just to getx approved quickly.

How Are They Doing It?

Tactics are mostly tech-driven, and these are the three specific ways that many residents in the Atlanta study are getting away with fraudulent applications and bypassing otherwise strict screening protocols.

Many tenants have found ways to create fake documents that they’re submitting with their applications. Generative AI has a lot of benefits and drawbacks, and this is one of the challenges. Tenants can use AI and cheap digital editing software to easily create and forge pay stubs, bank statements, and employment verification letters. Anyone with even the most basic software can create a convincing fake document in minutes.

Tenants are purchasing "renter packages." And they’re buying them on TikTok. These packages are being promoted by TikTok accounts, widely shared, and available with fake social-security numbers and Credit Profile Numbers (CPNs). Near-perfect credit scores are provided, too. An online influencer with a large TikTok following recently sold such packages for $1,250, promising people with past evictions and credit scores as low as 500 that they would easily be approved for a luxury apartment in as little as two weeks. Tenants see this as a way to bypass traditional and legitimate screening systems. Instead of using their own information, they’re using this contrived information that they’ve purchased online from a social media content creator.

Landlord urgency is being used against those landlords. Smart tenants will exploit the need for leasing agents to quickly fill vacant units. These rental property owners and managers are often less concerned with combing through the screening report for inaccuracies and red flags and more interested in getting someone in place who is willing to sign the lease and hand over the move-in funds. If a tenant expresses that they’d like to move in within days, there should be some scrutiny to that urgency. It’s likely fraud that’s driving the timeline.

In the end, rental application fraud through forgery or falsified information highlights the growing desperation in the tenant pool and the necessity for smart screening systems. For tenants who are dishonest, this may seem like a quick fix, but they risk legal consequences and damaged reputations.

Effects of Rental Fraud

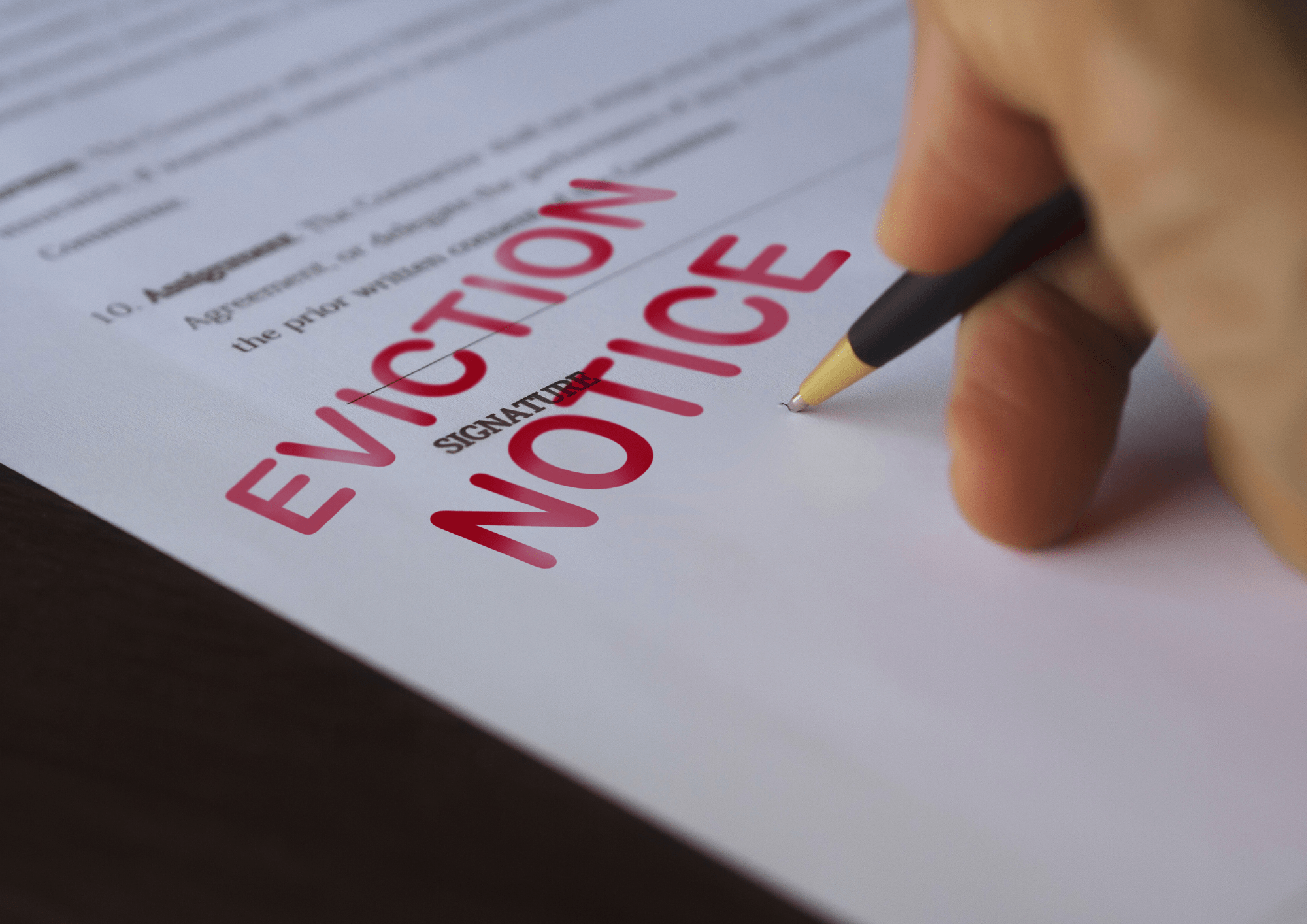

The cost of rental fraud is significant, especially to landlords who find themselves ultimately having to evict the tenants who were never qualified to rent their homes. Many fraudsters stop paying rent as soon as they secure their units. In Atlanta, the eviction process moves quicker than it does in LA. California’s eviction laws would mean that landlords could be stuck with nonpaying tenants for months and even years. One example from the Atlanta study we read highlighted a specific apartment complex in Atlanta where nearly the entire building was occupied by people who were approved after submitting fraudulent applications.

Rental application fraud poses serious risks for Los Angeles landlords and property owners. When tenants use forged documents or falsified information, landlords may unknowingly lease to individuals who cannot afford the rent or have problematic histories. This often leads to missed payments, costly evictions, and property damage, all of which reduce profitability.

At Bell Properties, we spend valuable time and money on screening. When applications come in fraudulently, owners and property managers can also expect legal fees and additional repairs. These are costs that could have been avoided with honest applications. Fraudulent tenants can also disrupt community stability and trust within rental properties.

Ultimately, rental application fraud undermines both financial security and confidence in the housing market.

How LA Rental Property Owners Can Protect Themselves

What can be done to get ahead of this potential increase in fraudulent rental applications? Here are some important tips. First, we’ll always recommend working with our team at Bell Properties, where you’ll get serious systems, advanced technology, and an understanding of the laws and best practices around screening and detecting fraud.

Strengthen screening processes. Owners cannot rely on a single screening method, and they should never try to screen applications themselves. It’s too risky, not only because of the potential for fraud, but also because the laws are so strict in LA. We’re verifying employment and income directly with workplaces. We recommend requesting bank statements directly from banks and using verification services or software for any documentation that’s collected.

Look for potential red flags. Applicants with perfect credit scores may seem attractive, but they’re also quite rare. If a pay stub looks off or even too clean, follow up.

Invest in fraud detection software. We have access to AI-powered platforms that can identify suspicious patterns and even flag applications. This triggers a manual review of the information that’s been collected. Investing in new software can be expensive for property owners, and that’s why it’s a good idea to work with Bell Properties, where owners can leverage the technology that we already have.

Address fraud and its consequences in lease agreements. New leases should make clear that fraudulent applications are grounds for immediate eviction and potential legal action.

Our concern, at Bell Properties, is that the conditions enabling this fraud in Atlanta (high rents, a shortage of affordable units, a tech-savvy population, and social media platforms openly promoting fraud) exist in LA as well. Landlords who understand these tactics now will be better positioned to protect themselves if and if/when this trend reaches our market.

Bell Properties has a plan and is prepared to protect our owner clients. Contact the California experts at Bell Properties today.